Financial Literacy Crossword Puzzle (Free Printable Game)

Boost your understanding of personal finance with this engaging financial literacy crossword puzzle!

Whether your students are just starting to learn about money management or need reinforcement, this financial literacy worksheet is a great way to introduce key financial concepts in a fun and interactive format.

The puzzle helps students understand important financial topics like budgeting, saving, and investing, offering a dynamic method to improve their financial literacy skills.

**This post may contain affiliate links. As an Amazon Associate and a participant in other affiliate programs, I earn a commission on qualifying purchases.**

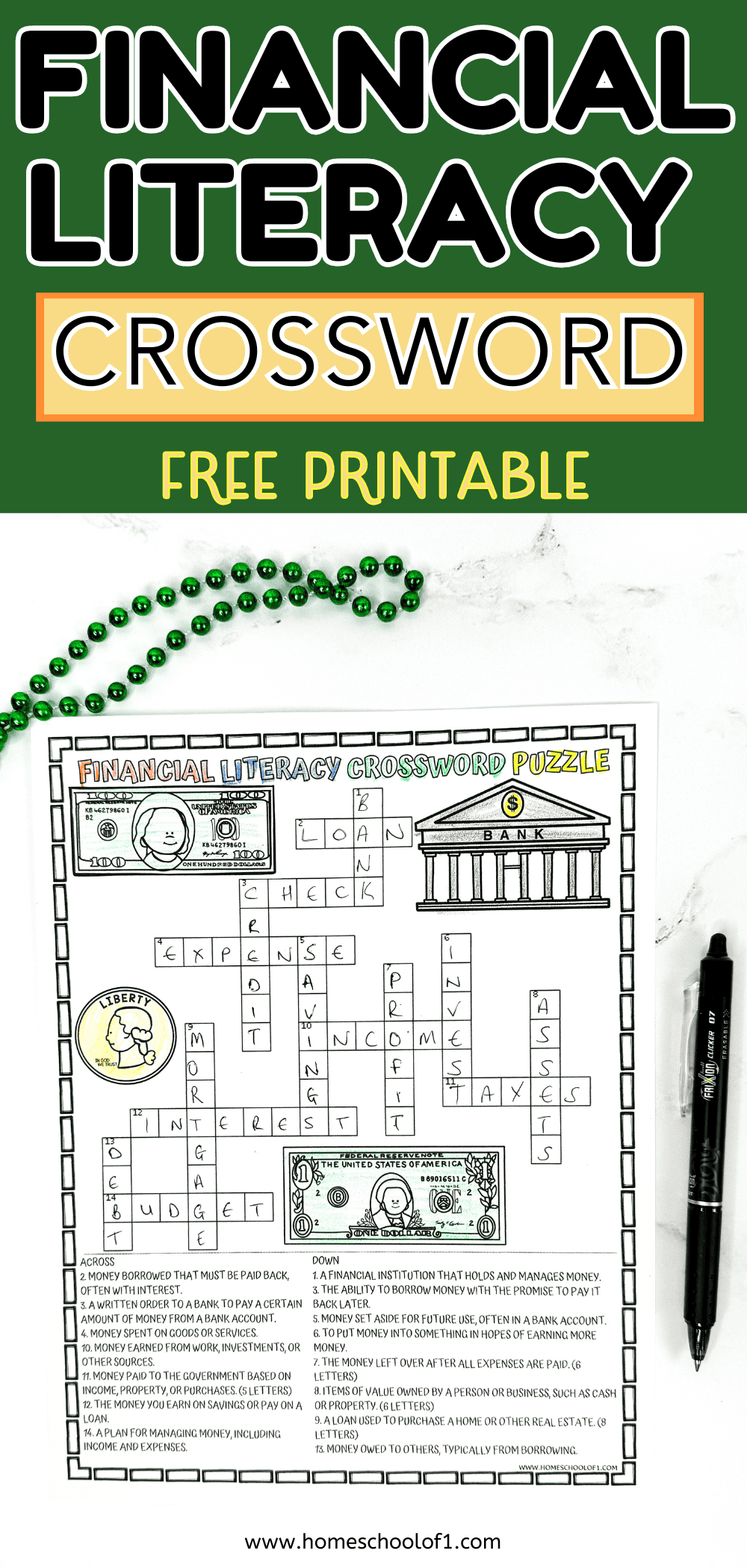

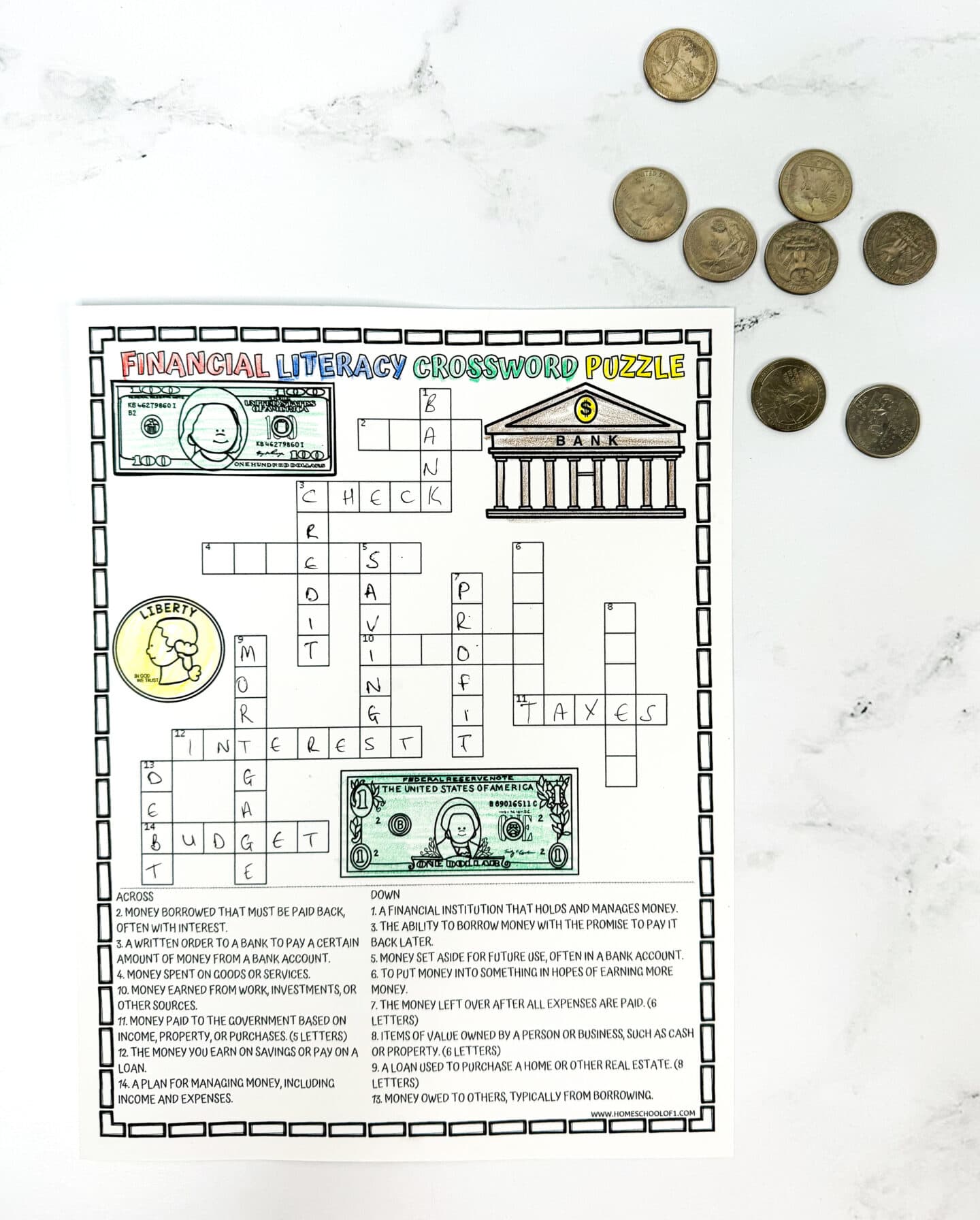

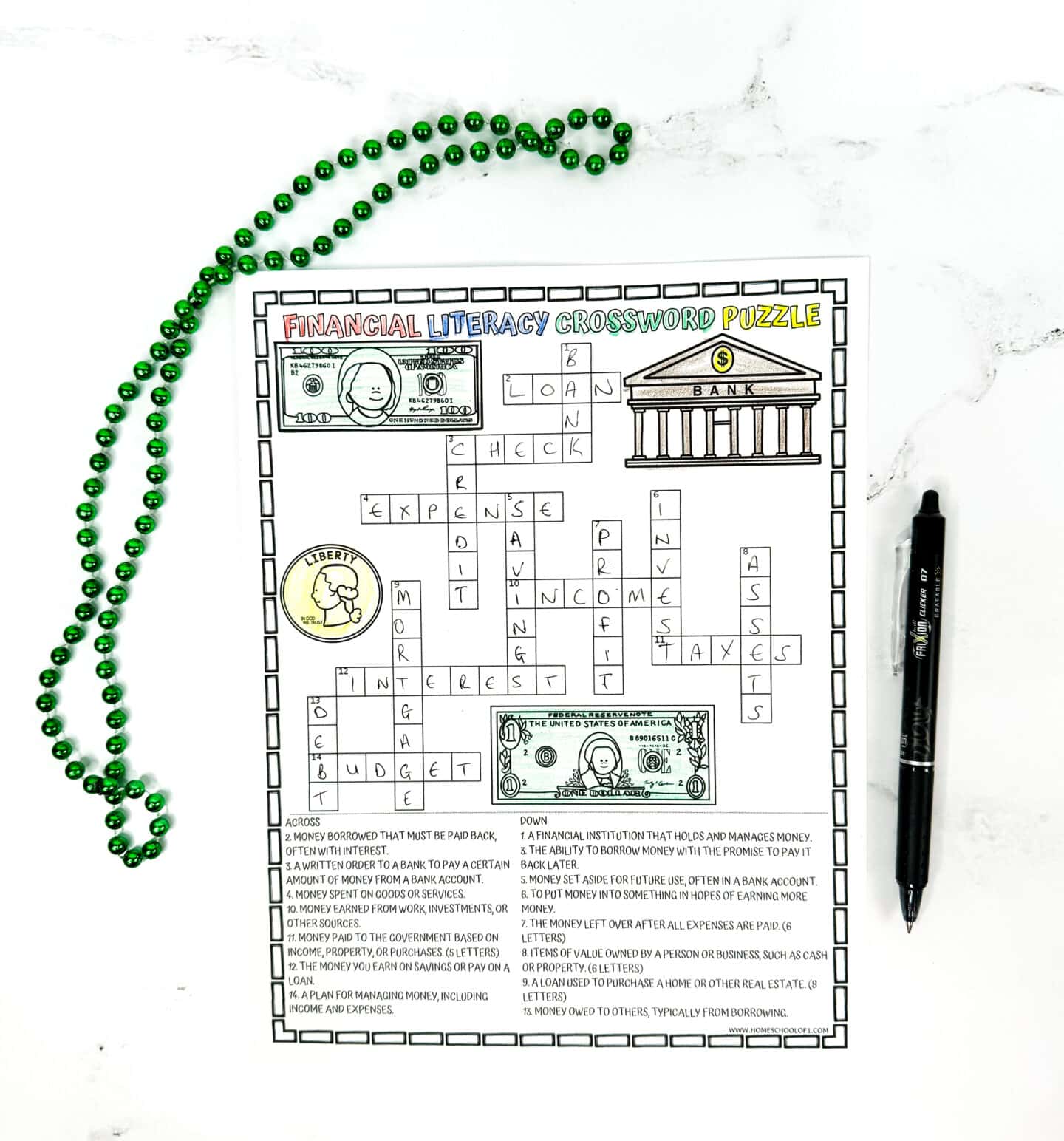

Financial literacy crossword puzzle

This free printable crossword puzzle is designed to help students grasp fundamental financial terms while keeping them engaged.

It’s perfect for middle and high school students and can be used as an in-class activity or homework assignment.

The puzzle covers topics like budgeting, saving, credit, and investing, providing a solid foundation in financial literacy.

Why use crossword puzzles to teach financial literacy?

Crossword puzzles offer a range of educational benefits, making them an excellent tool for reinforcing financial literacy concepts:

- Puzzles turn learning into an interactive activity, keeping students focused and involved. This active participation helps students retain information better than passive learning.

- Financial terminology can be complex, but crossword puzzles present these terms in a more approachable way. As students solve clues, they build their financial vocabulary in a context that makes sense.

- Solving crossword puzzles requires problem-solving and logical thinking—skills that are directly applicable to managing finances and making sound financial decisions.

- The clues are tied to real-world financial scenarios, helping students see how abstract concepts like budgeting and investing apply to everyday life.

How the puzzle reinforces financial concepts

Each clue in the crossword puzzle serves as a mini-lesson on an essential aspect of personal finance.

By completing the puzzle, students reinforce their understanding of how financial systems work, helping them prepare for more complex financial topics down the road.

Here’s how the puzzle supports key financial skills:

Students will learn the role banks play in managing personal finances, from holding savings to providing loans.

The puzzle encourages students to think about income and expenses, reinforcing the idea of planning for both short-term and long-term financial goals.

Clues about credit and loans help students understand the importance of borrowing responsibly and paying off debts to maintain a healthy financial standing.

By solving clues about savings and investments, students begin to understand the value of setting money aside for future needs and the potential benefits of investing.

Educational benefits of this tool

Using the financial literacy crossword puzzle in your classroom provides several advantages for students:

The puzzle format keeps students engaged, making it easier for them to remember financial terms and their meanings.

While the puzzle is a fun group activity, students also benefit from working independently, allowing them to tackle financial terms at their own pace.

By the end of the puzzle, students will have a stronger grasp of personal finance basics, giving them more confidence to handle financial decisions in the future.

Using the financial literacy crossword in your classroom

This crossword puzzle is a low-prep, engaging tool that can easily be integrated into your existing financial literacy lessons. Here are a few ways to use it:

Divide students into small groups and have them work together to solve the crossword. This promotes collaboration and allows students to discuss and learn from each other.

Assign the crossword as homework to reinforce concepts covered in class. It’s a great way for students to review financial terms at their own pace.

Use the puzzle as a review activity after covering a unit on personal finance. It’s an excellent way to gauge how well students have grasped key concepts before moving on to more advanced topics.

Kids will also love our favorite financial literacy board games.

Key financial concepts included

The puzzle includes clues that introduce students to important financial concepts, with a focus on everyday terms they’ll encounter in real life. The topics covered include:

- Money borrowed that must be paid back, often with interest. (Loan)

- A written order to a bank to pay a certain amount of money from a bank account. (Check)

- Money spent on goods or services. (Expense)

- Money earned from work, investments, or other sources. (Income)

- Money paid to the government based on income, property, or purchases (Taxes).

- The money you earn on savings or pay on a loan. (Interest)

- A plan for managing money, including income and expenses. (Budget)

- A financial institution that holds and manages money. (Bank)

- The ability to borrow money with the promise to pay it back later. (Credit)

- Money set aside for future use, often in a bank account. (Savings)

- To put money into something in hopes of earning more money. (Invest)

- The money left over after all expenses are paid (Profit).

- Items of value owned by a person or business, such as cash or property (Assets).

- A loan used to purchase a home or other real estate (Mortgage).

- Money owed to others, typically from borrowing. (Debt)

Need to print later? Add this to your Pinterest board or share it on Facebook. You’ll have it handy whenever you’re ready to use it!

Get the financial literacy game pdf here!

Ready to grab your free printable? Just pop your name and email into the form below, and it’s all yours!

Last Updated on 8 April 2025 by Clare Brown